E-Invoice

Carefree and according to EU standards

(EN) 16931

In 2028, it will be mandatory to issue electronic invoices in the B2B sector and the recipient's consent will be cancelled. This is according to EU standard 16931, which means that paper invoices will no longer be sufficient from 2028. We report on the most important points and why you should think about early changes. If you are interested in our options, we recommend sermocore.connect.

This type of accounting is currently used in the B2G sector. B2G stands for Business to Government and obliges public authorities to use electronic invoicing. sermcore also offers an excellent solution in the B2G area.

How does an electronic invoice work?

In order to issue an electronic invoice, a company must have set up a platform for electronic data interchange (EDI). This platform is connected to an ERP system. If an invoice process is triggered in the ERP, it creates an in-house data format. This is sent to the EDI platform, which handles the e-invoicing process. An e-invoice can be issued in various formats such as XML, ZUGFeRD, UBl, etc.

When does an invoice become electronic?

When it is issued, transmitted and received in a structured electronic format.

If the format enables the electronic and automatic processing of invoices.

In the case of PDF invoices, this means that although they are issued in an electronic format, this is only a digital representation of the invoice that does not enable electronic and automatic processing. A PDF invoice is therefore not a compliant e-invoice.

What happens to my PDF invoice?

You do not have to do without a PDF file. PDF invoices can still be sent, but only if an additional data record is added. It does not matter which electronic data format is used, as long as this enables electronic and automatic processing. sermocore has the option of creating a ZUGFeRD format. ZUGFeRD is a hybrid data format consisting of an A3 PDF and an XML file. ZUGFeRD is based on EN 16931 and is EU-compliant according to the e-invoicing law.

An important point is the authenticity of the invoice; it is irrelevant whether it is an electronic or physical invoice. In order to prove originality, the authenticity of the origin, the integrity of the content and legibility must be guaranteed.

Extract from the VAT. Directive (Article 233).

According to the VAT Directive (Article 233), every taxable person (i.e. both the supplier and the purchaser) must ensure that the "authenticity of origin" (i.e. the identity of the issuer of the invoice) and "integrity of content" (i.e. the content of the invoice has not been changed after it was issued) are guaranteed.

Mandatory fields of an e-invoice

- Process and invoice identifiers

- Invoice period

- Information about the seller

- Information about the buyer

- Information about the payee

- Information about the seller's tax representative

- Order reference

- Delivery details

- Instructions for executing the payment

- Information about surcharges or discounts

- Information on the individual invoice line items

- Total invoice amounts

- Value added tax Breakdown

What does this mean for my company?

The switch to e-invoicing, also known as e-invoice, means that every company is obliged to provide seamless data transfer. This means that a classic PDF invoice is no longer sufficient. If you are converting your invoice processing, you need to be aware of the following: A conversion is an intervention in your current system. Bear in mind the costs involved and the duration of the changeover. We recommend that you contact professional partners to avoid any nasty surprises. It is important that ongoing processes can be continued and that the integration takes place without complications. In our opinion, it makes sense to carry out a changeover in good time in order to have enough time for a smooth implementation. By converting early, you can avoid problems and minimise the costs incurred. As soon as you have customised your system, there will be benefits, which we will explain in the next section.

If you are looking for more information on e-invoicing, we recommend the WKO's Q&A. . https://www.wko.at/service/innovation-technologie-digitalisierung/fragen-und-antworten-zur-e-rechnung.html

Advantages of early changeover

- Lower costs

- Better cash flow

- More efficient processes & higher compliance

- Better control

- Conserves resources

- Fulfilment of future laws in the B2B area

How can sermocore help me?

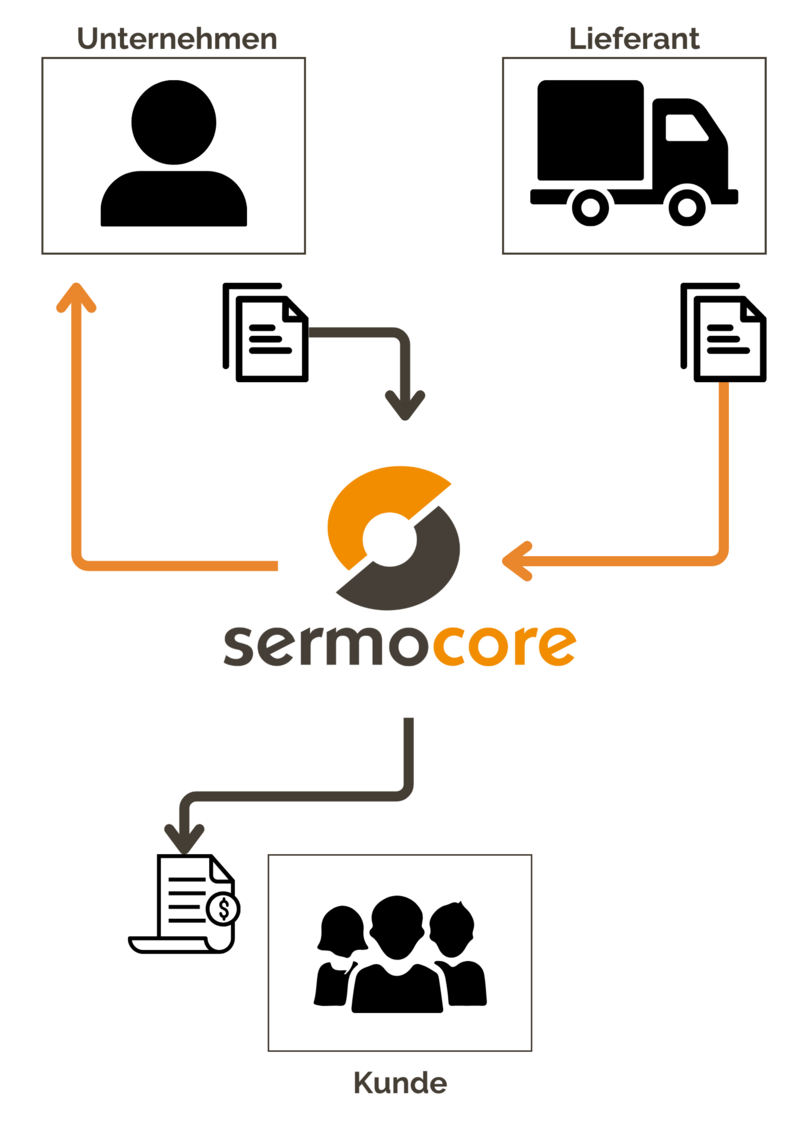

sermocore is an expert in the field of e-invoicing and has the ability to customise its processes to meet every type of customer need. By providing expert advice, sermocore helps with set-up, administration and maintenance. sermocore acts as an interface, or to put it simply, as a converter. Your ERP system records an invoice and wants to forward it to your customer. That's where sermocore comes in. We receive your invoices and convert them into an EU-compliant data format and then send them on to your business partner/customer. The data format that the customer receives is selected according to their preferences. If their e-invoice is incomplete, they are automatically notified so that they can correct it. The consignment is paused and only forwarded once it has been completed. This of course works for any type of data set and enables smooth collaboration with your business partners. sermocore also has the ability to convert invoices from business partners/customers and transmit them to your ERP system in the correct format

Why sermocore of all things?

- Compatible with all available ERP and financial systems

- We customise our services to your customer requirements

- Competent service is our top priority

- Problems are solved as quickly as possible by our specialists

- 110% implementation guarantee ensures risk-free implementation

Here's to a spirit of partnership

Stefan Müller, Corporate IT Supply Chain Engineer ALPLA

"As a software developer, I was pleasantly surprised at how quickly and easily we were able to realise the project despite the technically difficult specifications."

Maximilian Ott, Head of IT ELMAG Entwicklungs und Handels GmbH

"ELMAG has always endeavoured to be a pioneer in every respect. Be it in terms of product quality or service quality. It is important for us to inspire our customers holistically. The highly diverse and complex requirements for digital data exchange between us or our ERP system and our customers posed a major challenge. It was not easy to find a partner who was up to the challenge. With sermocore, however, we succeeded completely! We are absolutely delighted with the professional, competent collaboration and look forward to many more successful years!"

Stefan Pointner, Managing Director celox service GmbH

"As networkers, we are always on the lookout for competent partners. In sermocore, we have found a very flexible and reliable partner who supports us with excellent software solutions and expert know-how."